Using Behavioral Finance in Your Practice

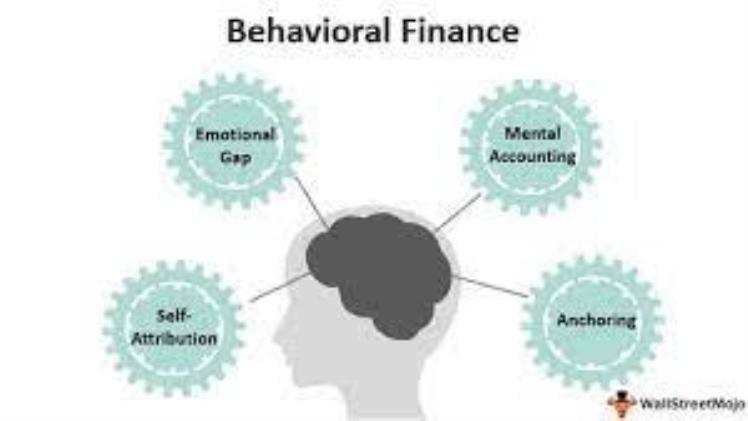

Behavioral Finance is an area of study that examines how investors’ psychology impacts their financial decisions. It explains why people behave in unique ways and how they can be manipulated by personal biases and psychological influences. It’s an essential topic for both investors and advisors alike, as irrational behavior often leads to costly errors in investing.

Established in the late 1970s, behavioral economics emerged out of an expanding body of research which highlighted irrational human behavior. The field sought to identify causes for such behavior, such as cognitive biases and limitations to bounded rationality.

One of the major breakthroughs in behavioral finance was Prospect Theory, which explored our responses to risk and uncertainty. It also addressed matters such as why we invest in risky assets and why stock markets don’t efficiently price equities.

Click here know about : Movierulz Kannada

Other aspects of behavioral finance draw on empirical findings about human reactions to various situations and money decisions. These insights can help investment professionals better assess their clients’ behaviors and financial decisions.

Utilizing Behavioral Finance in Your Practice

Understanding behavioral finance, whether you are new to it or an experienced investor, can be beneficial for both you and your clients. This knowledge will enable you to detect and avoid common errors as well as give your client’s investing decisions more informed guidance.

How Does Behavioral Finance Differ From Mainstream Financial Theory?

Mainstream financial theory typically assumes people are rational utility maximizers and markets efficient. Unfortunately, these assumptions have been disproven, leading to the field of behavioral finance which seeks to correct these errors through data collection and experimentation.

This approach has provided us with a deeper insight into why we make irrational decisions in the financial arena, and how this can influence our investment choices. It also gives us insight into why market bubbles and crashes occur so frequently.

In the 1970s, psychologist Daniel Kahneman and Amos Tversky made a groundbreaking discovery: they could identify and explain irrational behavior. Their work has since been widely published, finding application in fields such as business, politics, and finance.

Since then, behavioral finance has grown to encompass a vast array of topics and theories applicable to the investment industry. Though still relatively young, this field has made significant contributions to both finance and economics in general.

The Field of Behavioral Finance and Its Effect on the Stock Market

Behavioral finance is an emerging field that studies human behavioral patterns and how they influence market outcomes. It draws from psychological and economic theories to explain why some people make emotional or irrational decisions, or why their choices do not match what economic models predict.

Behavioral finance is an invaluable tool for advisors when making client financial and investment decisions. It helps you recognize the potential pitfalls in your clients’ choices and why they made them, so that you can provide them with advice that helps avoid costly errors. Ultimately, behavioral finance helps improve a client’s overall financial health and investing outcomes by eliminating any prejudices they may have and enabling them to make informed decisions.

By visit for multiple topic FashionTimesNow And F95zone